The Rise of LTC – Fueled by Legislation. Is Your State Next?

It happened last year. Agents with over 30 years of experience had never seen this phenomenon before. Healthy prospective clients lined up and knocking at their doors asking to buy insurance. Not just any insurance mind you. Long-term care insurance (LTCi). Insurance companies gladly obliged by supplying various LTC solutions. Some were on a life insurance chassis, some annuity, and some were pure, traditional long-term care insurance (Trad-LTCi). Predictably, sales records were shattered at every link in the chain – for agents, distributors (including worksite), and insurance companies.

Windfall and Havoc

In fact, there was so much consumer demand that agents from other states had to step up to help bear the load. Distributors and insurers added additional staff. Significant staff. One vendor described “truckloads of applications.” The app. counts were so tremendous that it impacted underwriting capacity for other states/territories at insurance companies. All hands were on deck to deal with the demand. Eventually, many insurers were forced to push the brakes by temporarily suspending sales. In some cases, it was effective immediately. Others implemented restrictions on the type of business they would accept to protect profitability including the addition of new rules on chargebacks.

And what was the source of this unparalleled avalanche of LTC business you ask? The unassuming state of Washington. WA Cares Fund. State funded care via a payroll tax ($0.58 for every $100 earned) for W-2 employees unless workers could demonstrate they had private insurance prior to the deadline of Nov 1, 2021. Doing so would allow them to “opt out” of the payroll tax. And, yep, you guessed it, many waited until the last minute causing the bottleneck. Although the effective date of the tax in WA has since been delayed until July 2023, the opt out deadline for escaping the tax (being exempt) still stands and expired last November.

LTC Sales in WA

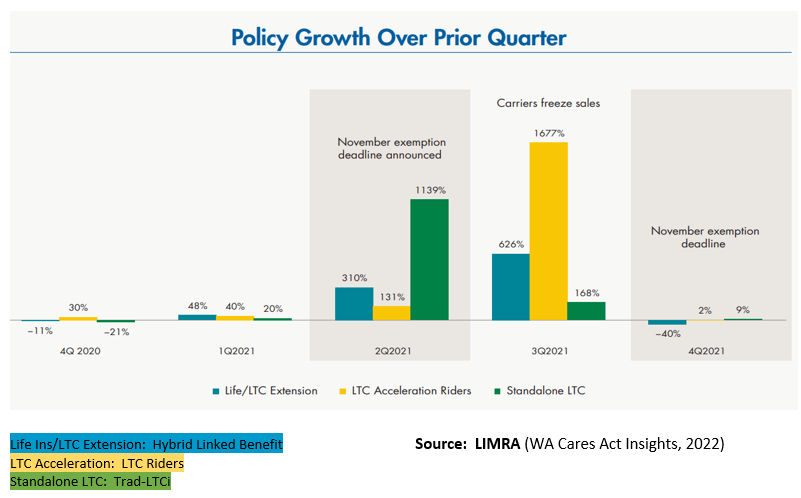

The bar graphs from LIMRA highlight the remarkable spike in sales and the drop off once the deadline was reached. In the case of Trad-LTCi, after decades of declining sales, it was refreshing to see the resurgence. Some had written Trad-LTCi off as a dying product. This is in spite of successful rate stabilization initiatives and the fact that Trad-LTCi is the most economical (and suitable) solution for some consumers – especially the underserved middle market.

For WA it’s important to know that only certain care solutions were eligible to exempt workers from the tax. Notably, Chronic Illness riders did not make the cut. Instead, only qualified LTCi solutions were eligible. You know, the ones which require a Health license to sell and ongoing CE (subject to state variations). Eligible LTCi in WA included: (a) Trad-LTCi, (b) LTC riders (life or annuity), and (c) Hybrid-Linked Benefit products (life or annuity). Additionally, the solutions sold were not just in the individual market. They were also in the worksite market to groups of employees. Now take a moment to consider the giant employers in WA and how lucrative it was for the firms that landed them. There was some serious money made in WA. Some distributors reported writing more business in the few months leading up to the WA cut off than they had in previous years (plural) combined.

Other States

So, what is going on, why, and which states are considering something similar? In short, a perfect storm is brewing beginning with demographics. An aging population of 70 million baby boomers will become increasingly in need of long-term care. This leaves states on the hook to bear the growing cost of expenses for those below the poverty line that rely on Medicaid. In the case of WA, they happen to be one of nine states with no income tax, adding to their short fall. Plus, the cost of care is skyrocketing across the country due to a growing shortage of care givers, aggravated by COVID and consumers’ preference to age in place at home. Today many states join WA, having some of the highest cost of care in the country. (BTW, cognitive impairments such as Dementia or Alzheimer’s are the leading cause of LTC claims lasting longer than one year).

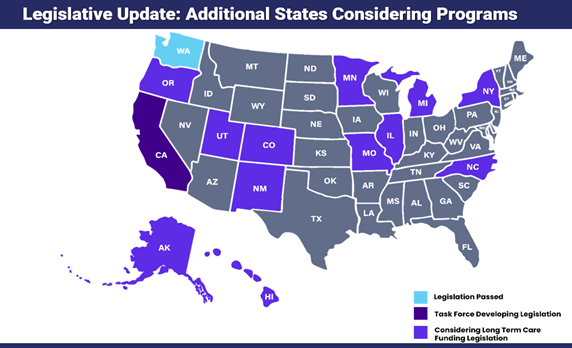

At last count, 14 states are considering publicly financed LTC programs: AK, CA, CO, HI, IL, MI, MO, MN, OR, PA*, NC, NM, NY, and UT.

* Bill in PA introduced 8/22/22 – is not reflected on Map

It remains to be seen if other states will offer an opt out window. If they do, it’s possible one would have to prove ownership of private LTC insurance, prior to the effective date (or some earlier date yet to be determined by the state). Interestingly, in anticipation of this, some savvy agents are getting ahead of the curve by purchasing their own LTCi policies in states like CA where they reside, to increase the likelihood of meeting eligibility exemption criteria (even though it’s not finalized). Why? Because the state of CA tax is expected to be considerably higher than WA. Understandably.

The Feds also have a big stake in the financing of LTC with the following proposals: (a) Credit for Caring Act, (b) The EARN Act, (c) Social Security Caregivers Credit Act, (d) WISH Act, and (e) Better Care Better Jobs Act.

What You Can Do

Since the state of WA brought insurers to their knees to the tune of carriers having to abruptly suspend sales, what would happen if a state the size of CA or NY were to implement similar legislation? (In NY, we recognize that only a fraction of insurers remain – of which only a handful offer LTCi solutions – only further complicating matters). Agents were unable to meet the insurmountable demand in WA. As a result, some freely handed off their clients to LTC licensed agents and firms and got zero commission. Others partnered with distributors and LTC specialists and split commissions. Regardless of the status of your state’s LTC legislation, what are you waiting for?

- If you don’t have your Health license – consider getting one or have someone in your office do so. (But if you wait until the last minute – it may be too late. The state or insurer may refuse you or be unable to process appointments due to last-minute volumes – as we saw with WA).

- Establish selling agreements and relationships now – with distributors who specialize in LTCi (or other LTC licensed agents since referrals flow both ways – which can be lucrative).

- Track LTCi legislation in your state along with updates from: Finseca, NAHU, and NAIFA. Don’t get caught off guard with your clients.

- Consider obtaining a LTC designation such as the highly respected and impactful CLTC designation.

- Welcome and accept offers from wholesalers to participate in their LTC sessions. Even though they will highlight their products strengths and sales applications, you will still gain excellent insights. (Some carrier’s wholesalers assist in point-of-sale support too).

It’s a Buyer’s Market

The rise in interest rates have been a welcome gift to those LTCi carriers issuing new business and a relief to those managing in force blocks – since interest rates are a primary driver of profitability. And in case you missed it, for Hybrid-Linked benefit products on a life insurance chassis, we have already seen 6 rate decreases on new business so far this year: Lincoln (twice), OneAmerica, Securian (new product), Nationwide, and Brighthouse (10/3/22). In some cases, these have been solid, double-digit rate decreases. Some LTC industry professionals have privately voiced their concerns that some of these prices were already too low and that the price reductions may not be solely attributed to interest rates. This could imply that carriers are either using more optimistic actuarial morbidity assumptions in their updated pricing or cutting their profit margins to beat competitors. We can’t know for sure – it’s proprietary.

Regardless, insurers assume the risk associated with guarantees and must meet the reserve requirements to fund future claims. Hybrid life insurance products are guaranteed. All of them. The Hybrid solutions on a life insurance chassis offer a guaranteed premium, guaranteed death benefit, and a guaranteed LTC benefit amount (some include additional non-guaranteed LTC benefit amounts or additional non-guaranteed extended LTC durations). Of course – a prudent buyer should consider a carrier’s financial strength. On that note, there are two new Hybrid entrants, and both have a perfect Comdex score of 100. Thrivent’s launch of CareForward, in April 2022, and Northwestern Mutual’s launch of Long-Term Advantage on 9/12/22.

Examples of Individual (Not worksite) LTCi Solutions

- Hybrid-Linked Benefit on Life Insurance: Brighthouse, Lincoln, MassMutual, Nationwide, New York Life, Northwestern Mutual, OneAmerica, Securian, and Thrivent.

- Hybrid-Linked Benefit on Annuity: Global Atlantic, Guarantee Income Life Insurance Company, OneAmerica. (Fingers crossed, in the coming months, EquiTrust).

- LTC Riders on Life Insurance: Equitable, Guardian, John Hancock, Lincoln, MassMutual, Mutual of Omaha, Nationwide, Northwestern Mutual, Pacific Life, Transamerica.

- Traditional Long-Term Care (Trad-LTCi): Bankers Life and Casualty Company, LifeSecure Insurance Company, Knights of Columbus, Mutual of Omaha, National Guardian Life, Northwestern Mutual, New York Life, Thrivent Financial.

Ready or Not

We are in the middle of a once in a lifetime career event, where the stars have aligned. Demographics. Consumer appetite. Legislation. Interest rates. Product availability. Ready or not, the rise of LTC is here. The question isn’t if your existing clients or prospective clients will be buying LTCi. The question is, will they be buying LTCi from you.

Ramona Neal, CLU, ChFC, CLTC, REBC

This article is intended for Financial Professional Use Only. Living Benefit Review, LLC makes no warranties or representations as to its accuracy. This article should not be construed as rendering tax, insurance, investment, or legal advice. You acknowledge that any reliance on this material or any opinion, statement or information shall be at your sole risk. If you take any action based on the information in this article, you take full responsibility for the results of that action. You should independently verify its content. Nothing in this article constitutes an offer to sell or buy any insurance product or rider. Products and riders, including benefits, exclusions, limitations, terms, and definitions vary by insurance company and vary by state.

Be the first to know