Prediction, Life Sales after 2020 Crash

Which Life Insurance Products Rose in Sales after the 2008 Market Crash?

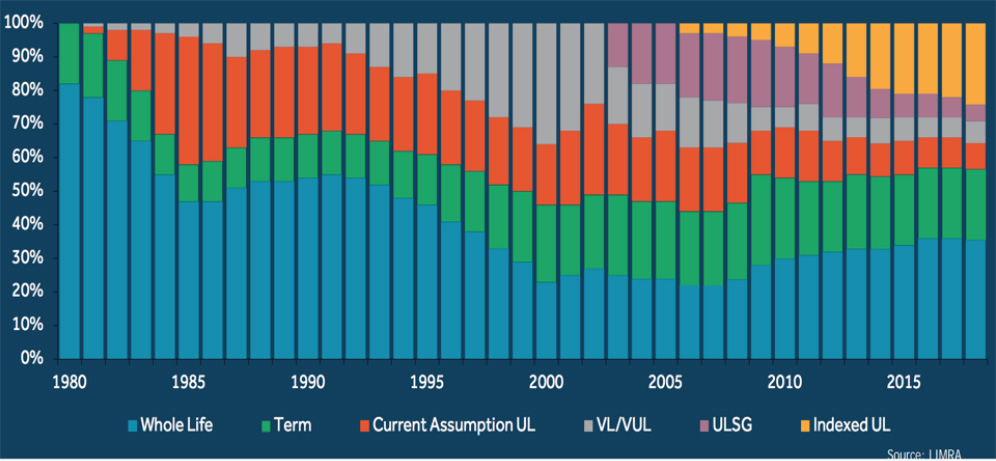

As consumers watched their 401k’s and investments tank, some of us learned for the first time, that it hurts more to have a negative -25% return, than it feels good to earn the same. Consequently, in the life insurance industry, advisors and consumers flocked to safety. Specifically, (a) they wanted products that offered the Big “G”- GUARANTEES, (b) they required strong financials with high Comdex ratings from companies, and (c) for a few years, life insurance shifted more towards a protection priority focus vs. investment. As a result, the sale of Whole Life (WL) products rich in guarantees flourished (guaranteed premiums, guaranteed cash value accumulation and guaranteed death benefit). Pure protection Term insurance sales also increased as a temporary solution for a good price. Meanwhile, UL products which offered guaranteed premiums and a guaranteed death benefit, Guaranteed UL’s (GUL’s, aka: ULSG) maintained their prominence as the preferred UL solution and became the #1 selling product for some companies. Not surprisingly, at the same time the sale of Variable Universal Life (VUL’s) declined with their sub-account market participation.

How some Insurers that Sold Universal Life Products Reacted after 2008:

Due to the pressure of declining interest rates, we watched numerous companies abruptly suspend the sale of their no-lapse Guarantee UL’s (GUL’s) both temporarily and permanently. For those that remained, many implemented actions for new business like: (1) double digit rate increases (2) 1st year maximum premium limits, (3) restricting the sale of GUL to their career agents exclusively, or (4) prohibiting Term conversions into their GUL. This left some companies with a void for a product solution as the price of GUL’s continued to rise. Then a new “GUL” variation was introduced. It did Not offer a lifetime death benefit guarantee. Instead it offered a life expectancy guarantee such as age 87, in return for a lower price and better cash value opportunity. The expectation is that the current interest rates credited, will carry the policy keeping it in force for the insured’s life. This design allows a company to hold less in reserves due to the shorter duration guarantee, but also shifts some risk to consumers. This is because, if a company lowered interest rates in the future, and/or increased charges, and the insured lives beyond the illustrated life expectancy such as age 87, then the price of continuing the policy could become excessive. Simply put, if the increased premium is not paid then the policy could lapse. However, for GUL’s the risk is retained entirely by the insurance company so long as: the required premium is paid, as scheduled, and on time. (Then both the premiums and death benefit are guaranteed for the period selected such as age 105). A few years later, the insurance industry was rocked by Indexed UL (IUL). By ~2011, the growth momentum of IUL could no longer be ignored. It became the lifeline to insurers not able to sell enough GUL, and for those that had suffered from declining VUL sales. For advisors and consumers it was the perfect solution as an alternative to criticisms against Accumulation UL’s (low interest rates) and VUL’s (risk of negative returns). Today, IUL still has a stronghold being a leader of life insurance sales by product category. Often Index UL’s only rival is WL which still dominates life insurance sales by product as well.

What to Expect from Life Insurance Product Sales After the 2020 Crash:

We are in a similar circumstance with volatile markets and historically low interest rates like we were in 2008. Therefore, low hanging fruit is – that past advisor & consumer behavior is the greatest predictor of future behavior. So, one would expect WL, Term, and GUL sales to rise. For GUL, a handful of companies today even offer a guaranteed Return of Premium (ROP) at set times in the policy and others offer some guaranteed cash value accumulation making them even more appealing. I anticipate a shift towards a protection priority focus again. Therefore, I predict any product that has an optional extended Death Benefit Guarantee Rider or ones that offer built-in life expectancy guarantees, will see an uptick in sales on any chassis: VUL, IUL or UL. Additionally, for the last 10+ yrs., the most popular riders on life insurance have been Chronic Illness and LTC riders, and more recently Critical Illness. These riders are sometimes automatically included and when offered as an option, I predict even higher election rates due to the pandemic.

Top Prediction – What to Expect after 2020 Crash: A “new” solution – 1 Product that Combines Both Life Ins and LTC (Hybrid – Linked Benefit)

What’s unique in 2020 which we didn’t see in 2008 is the added stressor of COVID-19 on top of the economic crisis, which can compound a consumer’s desire for flight to safety. We are all being bombarded by the harsh reality of Death and Sickness, forcing us to consider our own Mortality and Morbidity. As some take an inventory of their personal portfolio, they are finding gaps in life insurance and no means to cover LTC expenses. Then the freighting reality sets in, that they don’t have what they need. For this reason, I predict an increase in sales of hybrid products. Back in 2008, there were 3 companies which offered a Life Ins/LTC solution: Lincoln, State Life (and Genworth which exited the market). Today, there are 9 companies which offer robust solutions to meet consumer needs: Lincoln, State Life, Pacific Life, Securian, Nationwide, MassMutual, New York Life, RiverSource and Brighthouse. The appeal of linked benefit products is they offer the Big “G”: (a) Guaranteed Premiums, (b) Guar Return of Premiums or Guar Cash Value Growth, and (c) a Guar Death Benefit. In addition, if the insured is deemed Chronically Ill or severely Cognitively Impaired, then they also have (d) Guaranteed LTC benefits. Not only will they be able to accelerate the death benefit for LTC expenses, they can also get extended benefits beyond their death benefit for long term care needs, such as 2-3 times their initial death benefit. Naturally, predictions are only opinions. We know that only time will tell us which products will actually – demonstrate an increase in sales after the 2020 market crash and pandemic. Still, I think we can all agree that today – consumers are in tune to the reality of death and sickness more than before, so likely more open to buying life insurance.

For Financial Professional Use Only.

Not for Use with the Public.This article from Living Benefit Review, LLC was prepared for use with financial professionals who are experienced in insurance and/or investment matters. As a result, it should not be reviewed or relied on by any other persons. LBR does not provide tax, investment, insurance, accounting, or legal advice. Any tax statements contained herein, cannot be used for the purpose of avoiding U.S. federal, state, or local tax penalties. LBR articles are general and accordingly, should not be considered investment advice or as a recommendation that any particular company, product, rider, or feature is appropriate or suitable for any particular individual. State variations and availability may apply to insurance company products and/or riders. This article and any views or opinions expressed are for informational purposes only and are not guaranteed for accuracy.

Be the first to know