OPINION: Is New York’s Dept of Insurance Discriminating Against the Middle Market?

OPINION: Is New York’s Dept of Insurance Discriminating Against the Middle Market?

Regulators by definition wield authority. With New York’s Department of Financial Services, (fka: New York Department of Insurance), we have seen them exercise dominion for decades. It reminds me of a chokehold. Like Putin’s communism. Consequently, each link in the New York insurance chain is corroded or broken. All have been wounded. Insurance companies. Distributors. Agents/Advisors. But most importantly, the residents of New York. Particularly, the hard-working middle class who have sadly experienced the greatest hit. Ironically, New York’s Department of Financial Services (NY DFS) is known for taking pride in their “consumer advocacy”. They come off as touting every penalty or fine imposed against insurers as if it’s a win. Like a badge of honor.

But not so fast. Maybe NY’s DFS can’t see the forest for the trees. After all, for every handful of consumers “helped” they’ve simultaneously disenfranchised hundreds of thousands of New Yorkers. And for every hundred thousand dollars “gained”, they’ve cost New York losses in the millions.

What has NY’s DFS been getting Wrong for So Long?

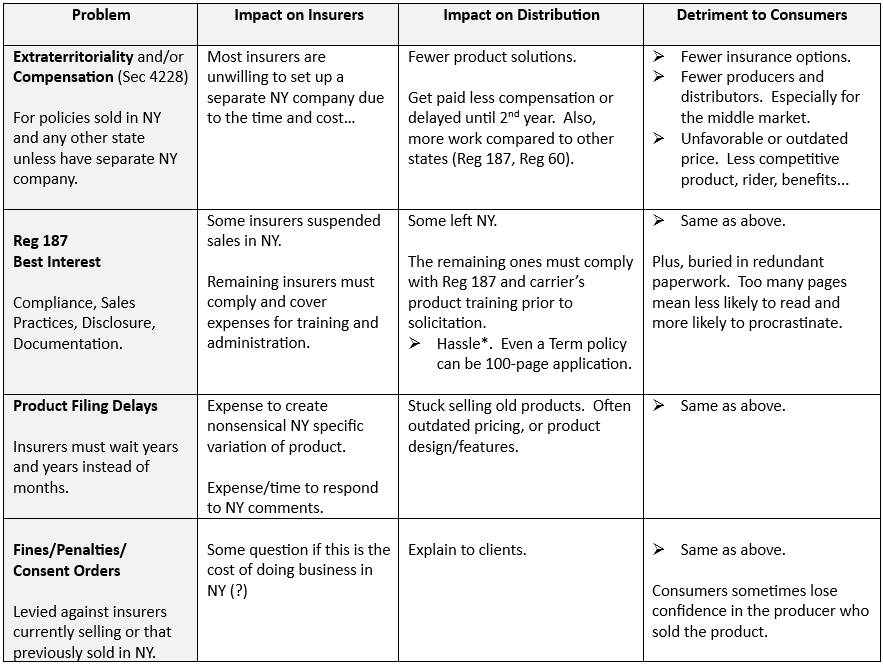

A lot. Here are a handful of examples.

*If Joe Millionaire is looking for a $1M Term policy, consider the time it takes the producer to ensure they have complied with “best interest”. Now consider that Joe Working Class is looking for a modest $100K policy. The producer already gets paid less in New York (and there are only so many hours in a day…). Additionally, New York producers who don’t focus on insurance are sometimes overwhelmed by the process. So, if their clients need insurance, they still don’t offer it. (Meanwhile the wealthy have other avenues).

What about Antitrust Violations?

Consider geography as it relates to antitrust compliance which insurance companies must adhere to. They are prohibited from colluding or coming to an agreement with one company doing business in region X and the other in Y. Now, instead of my asking you to walk a tight rope speculating on New York… I’ll just ask you to ponder one concept. The spirit of antitrust laws. They guard against monopolies and disruptions in the flow of competition. If these laws did not exist, then consumers could not benefit from a competitive market. As a result, they would be forced to pay higher prices due to a limited supply. Now consider exactly where we are in New York.

Let the chips fall where they may.

What about Redlining?

Redlining. A bad “four letter” word in insurance. We likely picture a property casualty sales manager with a red marker and map – excluding low-income neighborhoods. Could this possibly apply to NY’s DFS? Well, let us ponder again. Some New Yorker’s own property like a vacation home or a business in another state. This gives them a nexus (financial tie) to those states. Translation, the wealthy have the choice to purchase superior insurance from other states. They aren’t stuck with the New York version.

Back to redlining. I’m not asking you to consider the intent. I’m asking you to consider the effect. New York’s working class do not have the means or the privilege of nexus to other states. They often end up with an inferior offering, higher costs, and certainly with far less access to producers. Sometimes, they end up with no insurance at all. Now, let’s dive a little deeper. Are people of color more likely to be represented in low-income neighborhoods?

If so, then NY DFS, what have you done?

Light Bulb:

As a military veteran, I’d like to take a moment and:

- Recognize the fraction of carriers that are still in New York. Thank you for your service. (Life insurance, Annuities, and Long-Term Care insurance).

- Acknowledge insurers that exited New York after Reg 187, Reg 213/PBR (NY version), or other drama. With great sincerity, we empathize.

- For those that never considered entering. Understandable.

Dear NY DFS, get off your high horse. Instead of making it so difficult to do business to the tune that many insurers won’t even consider New York, why not unlock your door, and let insurers in? Please. Instead of appearing to be punitive – desperately seeking revenue from fines from an ever-dwindling set of carriers… Why not appear to operate above board? Consider generating dollars from the sale of new insurance business via a premium tax. My gosh. It’s so elementary. You can collect more premiums from far more insurers and far more policies. You know – just do what other states do. (Like the ~44 states in the Interstate Compact).

You’re welcome.

Is NY’s DFS getting anything Right?

Yes. If you already have an existing NY in-force policy, you are sitting pretty since it’s under the umbrella of NY’s DFS. Insurance companies are less inclined to implement a price increase in New York when compared to other states. I vividly recall one example after the 2008 market crash that would almost be comical but for the seriousness of this matter. An insurer that is no longer with us implemented an in-force action to increase life insurance COI charges in other states. Then they made attempts in New York but ultimately decided against it. Pretty much their flyer said New York made it too difficult, therefore… Never mind.

So, I give you this: All things being “equal”, I’d prefer my existing in-force policy be under the protection of NY’s DFS rather than another state.

White Flag

The elephant has been sitting in the room for a long time and we can no longer turn a blind eye to NY’s DFS. They have lost their way. Sure, thousands of NY policy owners are helped. But millions more have gone without and are harmed. The purpose today is not to throw shade on any individual at NY’s DFS. On the contrary, I’m respectful of their highly talented and credentialed leaders (and their workers too). The purpose is to critique the institution which has demonstrated systemic failed priorities for decades.

The white flag of negotiation has been raised. Will the response be to shoot all the messengers? Or will the response be to explore the best interests of all New Yorkers? Quite plainly, the outcome will reveal their motives (know them by their fruit).

NY’s DFS should build trust and partnership with insurers, distributors, and producers. Most importantly, they need to grow confidence with their tax paying constituents. New York should unlock their door and abolish restrictive regulations which have only backfired. Backfired badly. This will allow for fair competition resulting in better options for consumers. They could also consider joining the Interstate Compact. This would signal an enormous gesture of goodwill. A big win benefiting all at every link in the chain.

Although change isn’t easy. It can be done. The time is now for NY’s DFS to end what some perceive as a communist like chokehold. For me personally, having been born into a military family, it’s intriguing that the country listed on my birth certificate no longer exists. Why you ask? Because a U.S. President once said, “… If you seek peace, if you seek prosperity for the Soviet Union and Eastern Europe… Come here to this gate… Mr. Gorbachev, Tear Down this Wall”!

Yes, yes – – we all know that a whole lot occurred leading up to that famous utterance and to the eventual fall of the Berlin Wall. And do you know what else? A lot occurred in New York prior to this moment too. So, on behalf of the working class… On behalf of those that are disenfranchised and who don’t have a voice, Mrs. Hochul, Tear Down these Regs.

Ramona Neal, CLU, ChFC, CLTC, REBC, President, Living Benefit Review, LLC

Living Benefit Review, LLC makes no warranties or representations on the accuracy of the above views. It should not be construed as rendering tax, insurance, investment, or legal advice. You should consult your tax and legal advisors about any specific situation. You acknowledge that any reliance on this material or any opinion, statement or information shall be at your sole risk. If you take any action based on this information, you take full responsibility for the results of that action. You should independently verify its content. Nothing in this opinion piece constitutes an offer to sell or buy any insurance product or rider. Products and riders, including benefits, exclusions, limitations, terms, and definitions vary by insurance company. In addition, state variations and exceptions apply.

Be the first to know