Unstoppable: 10 Price Improvements and a Funeral. Hybrid Life-LTC.

Last May, Pacific Life suspended sales of their Hybrid Life-LTC product – the “funeral”. But between January 2022 and January 2023, we witnessed a remarkable waterfall of life. Two insurers entered the Hybrid Life-LTC market, and for the remaining seven – there were a total of 10 rate decreases in 12 months. In some instances, certain Hybrid carriers announced 2 and 3 price reductions during this period. And I’m not talking modest improvements. I’m talking robust double-digit rate decreases. Sometimes as much as 25%. Across the board. In one sweeping action. Quite frankly, it is unprecedented for this product category, which is now thirty-five years old.

Hybrid products are attractive to carriers because they bring cash in the door with large single pay and short pay premiums. This allows them to earn investment income at interest rates that have not been this high in the last 10+ years. Then consider that LTC claims typically do not have to be paid for 20+ years down the road.

The nine companies in this market today are: Brighthouse, Lincoln, MassMutual, Nationwide, New York Life, Northwestern Mutual, OneAmerica, Securian, and Thrivent.

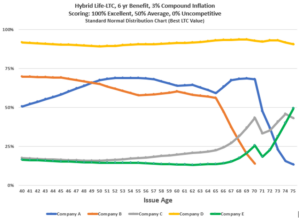

Hybrid-LTC Price Example – Comparing 5 Carriers (1/2023):

Lessons Learned

For LTC professionals the Hybrid rate reductions were reminiscent of price wars seen with Traditional-LTC in the 1980s. Of course, most Trad-LTC carriers have since exited this market and some are literally no longer with us. The challenges incurred were primarily due to flawed pricing assumptions with lower than projected voluntary lapse rates, lower than projected interest rates, and actual claims experience lasting longer than projected. It was a recipe for disaster for Trad-LTC policy owners and their families. Many are painfully having to choose between (1) an in-force rate action increasing their premium for the same benefit or (2) a reduction in LTC benefits for the same premium. Meanwhile, their agents are in the difficult position of having to explain it. The good news for Trad-LTC policies sold today is that recent rate stabilization initiatives are so conservative that it makes future rate increases highly improbable.

For life insurance professionals, the unprecedented Hybrid price reductions are reminiscent of GUL price wars in the mid-2000s. I still recall one insurer’s GUL price slash being so substantial it was perplexing. You only need to be ranked #1 on the spreadsheets, right? Did you really need your price to be 20% less than the #2 ranked carrier? You only needed to win (you didn’t have to give away the farm). It should be noted that this insurer, along with several others focused on GUL during that period, are no longer with us today.

Due to prolonged low interest rates in the 2000s, capital concerns, and high reserve requirements, GUL’s were abandoned by most insurers. This gave rise to IUL which shifts risk to consumers – since most aren’t guaranteed. The key with GUL was they are absolutely guaranteed. So, minus policy owners failing to make their GUL premium payments (precisely on time and as scheduled), the risk is entirely borne by the insurer. Today, some carriers that sold GUL have publicly acknowledged flawed pricing assumptions. However, for GUL carriers, there isn’t an option for in-force actions to increase premiums. Instead, they would have to eat it (writing down the losses). They could also try to incentivize policy owners to surrender their policies with cash buy back options. Guarantee really does mean guarantee.

Hybrid Guarantees

So, there we have it. Price, interest rates, and guarantees. Well, Hybrids have built-in guarantees. They offer guaranteed premiums, guaranteed death benefits, guaranteed LTC benefits, and varying degrees of guaranteed cash values or a return of premium. (I know, sweet). And as if that weren’t enough, some allow for additional benefits which are not guaranteed where (a) the LTC benefit amount can grow above the minimum guaranteed amount, or (b) the duration of the LTC benefit payments can be extended. This can be accomplished via dividends, or the underlying index/mutual fund (even sweeter).

The Criticism

Clearly the favorable rise in interest rates is directly attributed to the improved Hybrid pricing actions and is therefore justifiable, right (?). Well, behind the scenes (both inside some insurance companies and outside), critiques are ringing the bell to sound the alarm expressing legitimate concerns. They are questioning the frequency and intensity of the Hybrid price reductions, which seem to extend beyond the correlating rise in interest rates. The allegations include:

- Rapid changes in interest rates typically take longer to benefit pricing. Perhaps they are simply trying to buy market share.

- Are some Hybrids allowing for other products in their portfolio to subsidize the profitability assumptions of this line?

- Are some being too liberal with their actuarial pricing discretion? After all, even with pricing guardrails and standards of practice, there is not an industry table for morbidity assumptions (LTC/Health) which can be relied upon in assumption setting like there is for life insurance pricing with mortality tables.

- Are massive amounts of LTC coverage exposure potentially being generated?

- The biggest risk is – if insureds go on claim and then stay on claim much longer than was assumed in pricing. This could be caused by medical advancements which improve longevity that emerge in the next 20+ years (resulting in higher claims incidence and lower disabled mortality).

- Have we learned nothing from the price wars that came back to haunt some Trad-LTC & GUL carriers – where competitive price was arguably motivated by pressure to hit sales goals?

The Defense

In defense of the criticisms, here are some rebuttals (from both inside and outside insurance companies):

- Modeling Simulations: Today pricing models are far more sophisticated, comprised of thousands of simulations which help to better manage risk. (As opposed to “sophisticated” excel spreadsheets used years ago). This also benefits reinsurers.

- Rates: Hybrids are extremely financially sensitive to interest rates and probably more so than producers realize (due to single/short pays, combined with very long liability durations which heightens the sensitivity to earned rates). Initially, when interest rates rose in 2022, we saw carriers moderately improve price with their first action. It seems that once it was clear that higher rates were here to stay, they improved their rates even further. So, these two-step moves were more likely attributed to interest rates vs. price wars.

- First Dollar: The first dollar paid out with Hybrids is the client’s own premium. Let’s assume a $100k single premium is paid. This purchases (1) slightly more than $100k in death benefit (DB) and (2) also purchases a 2nd pool of pure LTC benefit in the amount of $400k at age 80 (indexed for inflation). Now consider this:

- Some policy owners NEVER go on LTC claim. So, upon death, they are receiving a return of their own premium. ($100k DB payable to their beneficiary).

- Of those that go on LTC claim, only 50% of claims last longer than one year. Again, accelerating the first pool, the DB (effectively their own premium) as a LTC benefit. Any remainder amount of the $100k not accelerated for LTC will be paid out as a DB to their beneficiary.

- For those that are on claim for more than one year, the average length of claim is 3.9 years. Now we are finally accessing the 2nd LTC pool, and this is what the Hybrid carriers are really pricing for.

- Improved Underwriting: Today’s Hybrid pricing reflects better morbidity underwriting than was assumed decades ago with Trad-LTC.

- Off Setting Risks: Hybrids are more risk diversified for insurers than Trad-LTC. Consumers with Hybrids are inclined to go on claim later when compared to Trad-LTC. This is because they are trying to preserve a remainder death benefit to be paid out to their beneficiaries.

- Historical Claims Data: Today we have the benefit of pooled industry experience of LTC data gathered to help in setting assumptions which includes far more conservative lapse rates. Although this isn’t recent – those carriers with a long history of in-force policies do have increasing experience to rely on. Additionally, new data analytic tools and approaches will lead to continued improvements. As claims emerge, there is a focus on new, advanced ways to model the outcomes – which tie back to the increasing sophistication of pricing models.

Tornados

When we consider the totality of the above – maybe now is the time to prioritize other metrics besides price. Certainly, price should not be the leading driver in product selection, right? Keep in mind – Hybrids are long-term care insurance (and life insurance). But this is not your father’s life insurance. Claims processing of life insurance is rather black and white (dead or not). Hybrids for LTC benefits – not so much. Contractual definitions matter. Go ahead, ask a Trad-LTC professional. They aren’t walking around carrying sales literature. Instead, they have the contract in hand – regardless of reimbursement or indemnity. Basically, even after one has met the eligibility criteria, 2/6 ADLs (activities of daily living) or severe cognitive impairment, it is not a once and done claim. (Plus, at a minimum, yearly annual recertifications). Long-term care insurance benefit payments are paid out over a period of years. Plural.

Tornados. We’ve all watched the heart-breaking scenes unfold on TV. Entire neighborhoods were destroyed. Homeowners desperately spray-painted their address and their insurers name on plywood – which is leaned up against their demolished property. I ask you, in that moment – would you be thinking, “I’m glad I saved money on my homeowner’s premium?” Or would you prefer to think, “I’m glad I purchased my policy from a financially strong insurer?” Which claims adjuster do you want to be holding a check book to process your claim?

It is your responsibility to do your own due diligence and identify which metrics to prioritize. But price shouldn’t be the only one – nor the leading one. Particularly since this is not a commoditized market. Other examples to consider:

- Financial Strength and Ratings

- Underwriting and Claims expertise

- Mutual company or Stock company

- LTC benefit durations: 4 years, 6 years, 8 years, or lifetime

- Underwriting Process

- Reimbursement or Indemnity

- Non-Guaranteed growth opportunities

- Guaranteed ROP/CV or Guaranteed DB in a given year

- Extended pay premium options from 5 years to age 100

Unstoppable?

The reality is, Hybrids are on sale right now and predictably many will likely run and not walk to offer this solution to their clients who can afford it. Additionally, the premium dollars generated by Hybrids has not gone unnoticed. More carriers are eyeing this space on both life and annuity chassis. This market will continue to grow, and so will the demand for long-term care insurance from consumers. Unstoppable.

What’s more, since interest rates are still on a rising trajectory, does it mean we can expect even more Hybrid price reductions? Don’t know. But we do know this, insanity is doing the same thing and expecting a different result. We are in this together. Insurers, distributors, agents, and most importantly, our consumers. So, if you are selling Hybrids and are predominantly focused on price… Please stop.

This article is intended for Financial Professional Use Only. Living Benefit Review makes no warranties or representations on this presentation. This content should not be construed as rendering specific tax, insurance, investment, or legal advice. Clients should consult with their tax and legal advisors about their specific situation. You acknowledge that any reliance on this material or any opinion, statement or information shall be at your sole risk. If you take any action based on the information in this presentation, you take full responsibility for the results of that action. You should independently verify its content. Nothing in this presentation constitutes an offer to sell or buy any insurance product or rider. Products and riders, including benefits, exclusions, limitations, terms, and definitions vary by insurance company. In addition, some state variations and exceptions apply. Not for Distribution to the Public.

Be the first to know